Handling VAT for EU customers can be tricky — and that’s where WooCommerce Plugins EU VAT comes in. This guide lays out ten of the best plugins, how they work, and practical setup steps so EU VAT on products, digital goods, OSS/IOSS flows, and B2B VAT number validation don’t slow down the business.

These plugins not only automate complex tax rules but also help you stay compliant with constantly changing EU regulations. By streamlining VAT calculations, generating audit-ready reports, and validating customer VAT numbers, they save both time and costly errors. Whether you’re running a small digital shop or a growing international eCommerce brand, the right VAT plugin can transform compliance from a burden into a smooth, reliable process.

What are WooCommerce Plugins EU VAT and why do they matter

“WooCommerce Plugins EU VAT” is a practical search term and category that covers extensions and plugins built to help

WooCommerce stores comply with EU VAT rules. These plugins help with VAT number collection and validation, calculating the correct VAT

rate for each EU member state, supporting OSS/IOSS reporting, and producing the records and exports needed for tax filing.

For stores selling digital services or shipping low-value goods outside the EU, EU VAT rules changed in recent years (OSS/IOSS),

making automation essential. Proper evidence capture (billing address, IP, and VAT number where applicable) and accurate per-country rates

are central responsibilities these plugins solve. WooCommerce itself documents how to set up EU rates for digital goods — plugins layer automation on top of that.

Also Read: Best WooCommerce Plugins Role Based Prices

How to use WooCommerce Plugins EU VAT

1. Install and test on a staging site: install the plugin on a staging copy of the store, not the live production site.

So tax behavior can be tested thoroughly without affecting customers.

2. Enter business details and VAT identity: most plugins require the seller’s VAT/OSS/IOSS ID (if registered),

business country, and whether the store sells goods, services, or digital items — these determine the rate and reporting logic.

3. Configure customer evidence rules (billing vs shipping vs IP) and where the plugin should apply reverse charge or exemptions.

Consult plugin docs for VIES validation or third-party API keys where required.

4. Map products and tax classes: decide which products are taxed differently (digital vs physical) and assign tax classes

so the plugin calculates correctly.

5. Run checkout tests from EU countries and with/without valid VAT numbers to confirm behavior,

then export sample reports to confirm format meets local filing requirements.

List of plugins WooCommerce Plugins EU VAT

Below are ten leading extensions that cover VAT number validation, OSS/IOSS support, automated rates, and reporting.

Each entry lists an overview, key features, and a starting price to help compare quickly.

1. EU VAT Number (WooCommerce)

The official “EU VAT Number” extension for WooCommerce lets stores collect and validate VAT numbers at checkout and

automatically exempt eligible B2B customers from VAT when validation succeeds. It’s focused on checkout collection and VIES validation.

The plugin integrates with WooCommerce tax rules so that a validated EU VAT number can trigger reverse charge handling and correct invoicing.

Note that UK VAT validation behavior may be limited depending on external API access — check the vendor’s advisory where UK VAT APIs are separately governed.

Key features

- Collect VAT numbers at checkout and on account pages.

- VIES validation for EU VAT numbers and optional exemption behavior.

- Integrates with WooCommerce taxes and order notes for audit trails.

Pricing: Starts at approx. $39 / year.

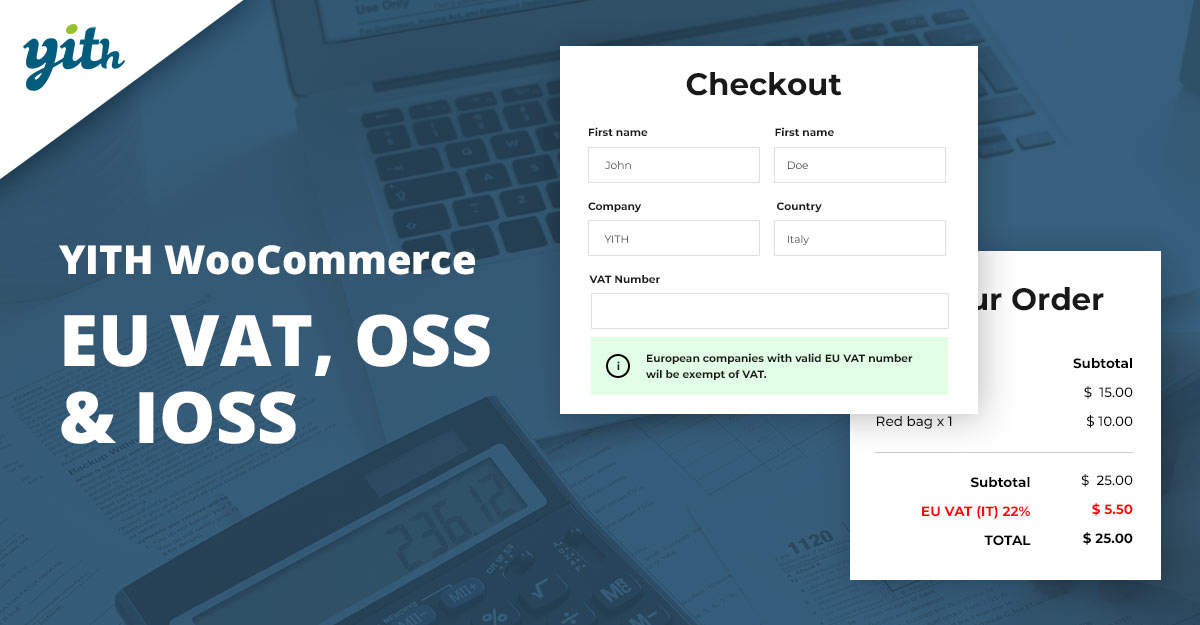

2. YITH WooCommerce EU VAT, OSS & IOSS

YITH’s EU VAT extension is built for modern EU trade: it supports OSS reporting exports, IOSS handling for low-value imports,

automatic tax application based on destination, and tools to prevent customers from bypassing VAT rules.

The plugin also generates CSV exports for OSS reporting, lets merchants charge IOSS VAT at checkout for goods under €150,

and attempts to automate record-keeping to simplify monthly or quarterly OSS filings. For stores dealing with cross-border shipments,

YITH’s approach can reduce manual reconciliation.

Key features

- OSS report export (CSV) and IOSS checkout handling.

- Country-based VAT calculation and validation rules.

- Controls to prevent orders from particular regions when required.

Pricing: Typically offered as a paid YITH premium plugin (price varies; commonly in the $79–$99/year.

3. WooCommerce EU VAT Assistant

EU VAT Assistant focuses on evidence capture, VAT calculations under the new regimes, and producing VAT reports for filings.

It extends WooCommerce to capture IP, billing, and shipping address evidence and supports VAT number validation where required.

This plugin is valued by merchants who want strong reporting features and a zero-cost or low-cost starting point to build compliance workflows

rather than a full third-party tax engine.

Key features

- Collects evidence for customer location (IP, billing, shipping).

- VAT number validation and exemptions for eligible B2B sales.

- VAT reporting exports to aid OSS/MOSS filings.

Pricing: Often available as a free plugin with paid add-ons or premium editions.

4. IOSS EU VAT for WooCommerce

The IOSS EU VAT extension automates charging VAT via the Import One-Stop Shop (IOSS) for non-EU sellers shipping goods under €150,

so customers see VAT charged at checkout rather than at customs. It simplifies cross-border selling for low-value shipments.

The extension can calculate VAT per destination country and supports configuration options for billing and invoicing that reflect IOSS requirements.

It’s useful for merchants who want to avoid their buyers getting unexpected customs bills or delays due to unpaid VAT.

Key features

- Charge IOSS VAT at checkout for qualifying shipments (under €150).

- Automatic VAT rate calculation by destination country.

- Integration with order metadata for IOSS record-keeping.

Pricing: Typical starting price: around $49 for a 1-year license from the marketplace where listed.

5. Quaderno for WooCommerce

Quaderno is an all-in-one tax automation tool that integrates with WooCommerce to calculate VAT in real time, generate compliant invoices,

and provide reporting across VAT, GST, and sales tax regimes worldwide. It includes automated receipts and tax reports that simplify filings.

For sellers operating across many countries, Quaderno’s compliance focus reduces manual tax work: it handles real-time tax calculation,

issues invoices that meet local requirements and preserves transaction-level evidence for audits.

Key features

- Real-time tax calculation and compliant invoice generation.

- Tax reporting and automated notifications for thresholds and filings.

- Global coverage (VAT/GST/sales tax) with WooCommerce integration plugin.

Pricing: Quaderno is subscription-based; plans typically start with a monthly fee plus per-invoice/transaction scaling.

6. TaxJar (WooCommerce integration)

TaxJar provides automated sales tax and VAT calculation and reporting. Its WooCommerce connector sends transactions to TaxJar for

rate calculation and, depending on the plan, can produce filing reports or offer autofiling services in supported jurisdictions.

The plugin is typically free to install but pairs with TaxJar’s subscription pricing — ideal for merchants who want accurate, managed tax calculations

and the option to outsource filing to a specialist service.

Key features

- Real-time rate calculation and order-level tax accuracy.

- Order-sync to TaxJar for consolidated reporting and filing.

- Transparent, order-based pricing depending on monthly volume.

Pricing: Plugin-free; TaxJar subscription starts at modest monthly tiers.

7. Avalara (AvaTax) for WooCommerce

Avalara AvaTax is an enterprise-grade tax engine that calculates VAT and sales tax with high accuracy using up-to-date tax rules and legislation.

It’s designed for merchants who need automated, reliable tax calculations across many tax jurisdictions.

The Avalara integration supports exemption certificate management and cross-border VAT calculation and is commonly used by larger stores or those with complex tax rules.

It requires an Avalara account and subscription.

Key features

- Automated, legally updated tax calculations across jurisdictions.

- Exemption certificate & compliance management.

- Scales well for high-volume or multi-region sellers.

Pricing: Pricing by Avalara subscription — contact Avalara for a custom quote.

Also Read: Best WooCommerce Plugins Ajax Search

8. EU VAT Manager for WooCommerce

EU VAT Manager plugins (sold by various marketplaces) focus on automating validation through VIES, applying correct tax classes,

and producing reports for OSS/MOSS returns. These plugins are popular with stores that need straightforward validation and country-specific rates.

They typically include admin interfaces for tax evidence, VIES validation logs, and exportable audit files for easy record keeping during audits.

Choose one that explicitly supports OSS/IOSS if that is required by the business model.

Key features

- VIES VAT validation and reverse-charge handling.

- Country-specific tax application and reporting exports.

- Integration with WooCommerce tax classes and checkout UI.

Pricing: Typically in the $30–$80 range, depending on the vendor and license type.

9. EU VAT (Booster for WooCommerce module / Booster.io)

Booster for WooCommerce is a multifunction plugin with an EU VAT number module. It’s useful when a merchant wants multiple store enhancements

plus VAT handling without adding many separate plugins.

The Booster EU VAT feature can add standard EU VAT rates, collect VAT numbers, and adjust checkout behavior — a cost-efficient option for merchants already using Booster.

Key features

- Predefined set of EU VAT rates and VAT number collection at checkout.

- VAT exemption rules and VIES validation support in some editions.

- Part of a larger Booster bundle (benefit: many linked features in one plugin).

Pricing: Booster offers tiers and lifetime deals; EU VAT features may be included in higher tiers.

Also Read: How to edit MailPoet WooCommerce email

10. WooCommerce EU VAT Compliance

This dedicated plugin helps with EU, UK, Norwegian, and Swiss VAT compliance by recording evidence of customer location, validating VAT numbers,

and generating exportable audit logs to support filings.

It is suitable for merchants who need robust evidence collection (billing/shipping/IP) and clean exports for accounting or tax agents.

Many users pair it with a tax engine or reporting tool for filings.

Key features

- Evidence capture (billing, shipping, IP) and validation logs.

- Support for EU & UK rules and exportable audit files.

- Integrates with WooCommerce tax settings and order metadata.

Pricing: Often free or low-cost on WordPress.org with paid pro add-ons; check the plugin page for the latest pricing.

Comparison table

The scrollable table below is paste-ready for the WordPress block editor. Column headings: Plugin | Key feature(s) | Price (short)

| Plugin | Key feature(s) | Price (short) |

|---|---|---|

| EU VAT Number (WooCommerce) | VAT number collection + VIES validation | ≈ $39/yr |

| YITH EU VAT, OSS & IOSS | OSS export, IOSS checkout handling | ≈ $79–$99/yr |

| WooCommerce EU VAT Assistant | Evidence capture + VAT reports | Free / paid add-ons |

| IOSS EU VAT for WooCommerce | IOSS charging for ≤€150 imports | ≈ $49 one-year |

| Quaderno for WooCommerce | Automated tax calc + compliant invoices | Subscription (monthly tiers) |

| TaxJar (WooCommerce) | Real-time tax rates + reporting | Plugin-free; TaxJar starts ≈ $19/mo |

| Avalara (AvaTax) | Enterprise tax engine + exemptions | Enterprise pricing (quote) |

| EU VAT Manager | VIES validation + reporting exports | ≈ $30–$80 one-time/yr |

| Booster EU VAT module | Predefined EU rates + VAT number collection | Booster tiers (varies) |

| WooCommerce EU VAT Compliance | Evidence capture + exportable logs | Free / paid pro add-ons |

Making EU VAT Simple for Your Store

Managing EU VAT can seem overwhelming at first, but the right tools make it far more manageable. With the variety of WooCommerce Plugins EU VAT available, every type of store — from small digital sellers to large cross-border

Businesses can find a solution that fits. Whether it’s simple VAT number validation or full OSS/IOSS compliance with automated reports, each plugin on this list addresses a specific challenge.

The key takeaway is to match a plugin to your current business needs while keeping future growth in mind. Start with a reliable validation and reporting tool, then consider more advanced options like Quaderno, TaxJar, or Avalara as complexity increases. Ultimately, these plugins not only save time and reduce errors but also help maintain trust with customers and ensure smooth, compliant sales across the EU market.

Interesting Reads:

How to Set Up WooCommerce One-Page Checkout